Understanding Exness Cent Account Spread: Maximizing Your Trading Potential

When it comes to trading currencies and financial instruments, understanding the nuances of spread and how it works is crucial for every trader. In this article, we will delve into the Exness Cent account spread, a popular choice among traders due to its unique features and advantages. Whether you are a beginner looking to start your trading journey or an experienced trader seeking to optimize your strategies, knowing how the spread works in an Exness Cent account can enhance your trading experience. Additionally, for further information on trading in different regions, visit exness cent account spread Exness Côte d’Ivoire.

What is a Spread?

The spread refers to the difference between the buying price (ask price) and the selling price (bid price) of a financial instrument. This difference is essentially the cost of trading, and it varies based on market conditions and the broker’s pricing model. Traders need to understand that the spread can significantly impact their overall profitability, particularly when engaging in short-term trades or scalping strategies.

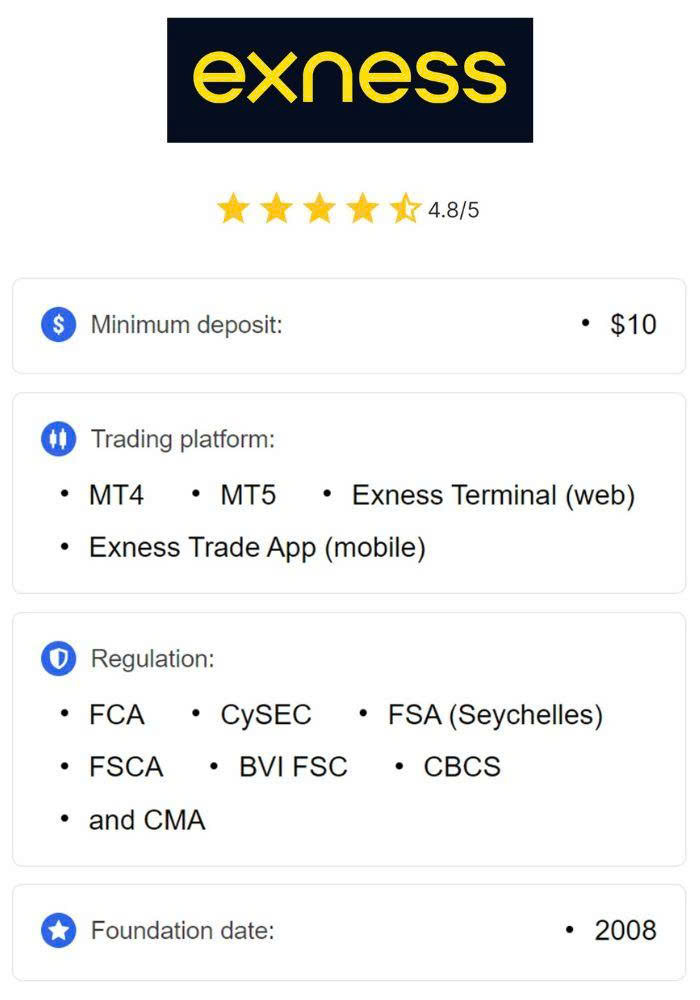

Exness Cent Account Overview

The Exness Cent account is designed specifically for those who wish to trade with smaller amounts of capital. This account type allows traders to operate with funds represented in cents rather than dollars, providing a low-risk environment particularly suitable for beginner traders. The initial deposit requirement for an Exness Cent account is quite minimal, making this option attractive for new entrants into the trading world.

Understanding the Spread in Exness Cent Accounts

One of the key features of trading with an Exness Cent account is its competitive spread. The spreads in Cent accounts can be significantly tighter compared to other account types. Typically, spreads start from as low as 0.0 pips on certain pairs, which means that traders can enter and exit trades with minimal cost, thereby improving their potential profitability.

Types of Spreads Offered

Exness provides various types of spreads on its Cent account, which may include floating spreads and fixed spreads. . Floating spreads can change according to market volatility, whereas fixed spreads remain constant regardless of market conditions. Depending on your trading style and strategy, you may find one type more preferable than the other.

Advantages of Trading with a Lower Spread

The benefits of trading with a lower spread are multifaceted:

- Cost Efficiency: Lower spread means lower costs per trade, which is essential for maintaining profitability, especially in high-frequency trading.

- Flexibility: The ability to open and close positions at lower costs allows traders to be more flexible in managing their trades.

- Enhanced Scalping Opportunities: For scalpers, lower spreads enable faster entries and exits, which is critical for their trading strategies.

Factors Influencing Spread on Exness Cent Accounts

The spread on Exness Cent accounts can be influenced by several factors:

- Market Volatility: During times of high volatility, spreads may widen due to increased market activity and risk.

- Liquidity: Currency pairs that are more liquid typically have tighter spreads than those that are less liquid.

- Time of Trading: Spreads can be narrower during active trading hours when the market is most liquid and wider during off-peak hours.

Tips to Minimize Your Spread Costs

Here are some practical tips to help you minimize the impact of spreads on your trading costs:

- Choose Your Trading Times Wisely: Try to trade during peak market hours to benefit from tighter spreads.

- Select Liquid Pairs: Focus on trading currency pairs with high liquidity to enjoy lower spreads.

- Utilize Limit Orders: Instead of market orders, consider using limit orders to manage the cost of your trades effectively.

Conclusion

The Exness Cent account spread offers a unique advantage for traders, especially those looking to start their trading career with minimal risk. Understanding how spreads work, along with implementing effective strategies to manage them, can significantly improve your trading results. By leveraging the low spreads associated with Exness Cent accounts, combined with proper risk management and market analysis, traders can maximize their potential for success in the dynamic world of forex trading.

Whether you are considering opening an Exness Cent account or are already trading, always remember that the spread is a vital component of your trading strategy. Stay informed, continue learning, and adapt your approach to the ever-changing market conditions.