Forex currency trading online has revolutionized the way individuals invest and speculate in the global financial markets. With the rise of the internet and mobile technology, trading currencies has become more accessible than ever before. Whether you’re a seasoned investor or a newcomer to trading, understanding the basics of Forex trading is essential for success. You can find the forex currency trading online Best Trading Apps to enhance your trading experience and streamline your strategies.

What is Forex Trading?

Forex, or foreign exchange, is the market for trading national currencies against one another. It is the largest and most liquid financial market in the world, with a daily trading volume exceeding $6 trillion. Traders engage in Forex trading with the aim of making profits by buying and selling currency pairs. For example, if a trader believes that the Euro will appreciate against the US Dollar, they may purchase EUR/USD pairs.

Understanding Currency Pairs

In Forex trading, currencies are quoted in pairs. The first currency in the pair is known as the base currency, while the second is the quote currency. For instance, in the EUR/USD pair, the Euro is the base currency, and the US Dollar is the quote currency. The value of the currency pair reflects how much of the quote currency is needed to purchase one unit of the base currency. Understanding how to interpret these quotes is key to successful trading.

The Role of Leverage

Leverage is a fundamental concept in Forex trading that allows traders to control larger positions than their capital would otherwise permit. For example, if a broker offers a leverage of 100:1, a trader can control a position worth $100,000 with just $1,000 of their own capital. While leverage can amplify profits, it also increases the risk of significant losses. As a result, it is crucial for traders to manage their leverage wisely and implement effective risk management strategies.

Types of Forex Orders

Traders utilize various order types to execute their trading strategies. The most common types of Forex orders include:

- Market Order: Executes a trade immediately at the current market price.

- Limit Order: Sets a specific price at which a trader is willing to buy or sell a currency pair.

- Stop-Loss Order: Automatically closes a position once it reaches a specified loss level, helping to minimize risks.

- Take-Profit Order: Closes a position once it reaches a predetermined profit level, securing gains.

Technical Analysis vs. Fundamental Analysis

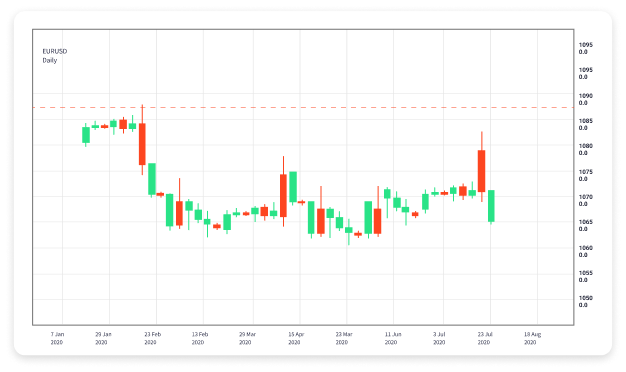

Successful Forex traders often employ two primary methods of analysis: technical analysis and fundamental analysis. Technical analysis involves analyzing price charts and historical data to identify trends, patterns, and potential entry and exit points. This approach uses various indicators like moving averages, relative strength index (RSI), and Bollinger Bands.

On the other hand, fundamental analysis focuses on economic indicators, geopolitical events, and broader market conditions that may impact currency values. For instance, interest rate changes, inflation reports, and employment statistics can significantly influence currency movements. Many traders combine both analyses to create well-rounded trading strategies.

Choosing a Forex Broker

Selecting the right Forex broker is crucial for your trading success. Factors to consider include:

- Regulation: Ensure the broker is regulated by reputable financial authorities to safeguard your investments.

- Trading Platform: Look for user-friendly platforms that offer a variety of tools and resources for analysis and trading.

- Spreads and Commissions: Compare costs associated with trading, including spreads, commissions, and any hidden fees.

- Customer Support: Reliable customer service is essential, especially for new traders who may require assistance.

Developing a Trading Strategy

A well-defined trading strategy is essential for success in Forex trading. Here are some key components to consider when developing your strategy:

- Define Your Goals: Determine your financial goals and risk tolerance before trading.

- Time Frame: Decide on a trading style, whether intraday, swing, or long-term trading, based on your availability and risk appetite.

- Backtest Your Strategy: Test your strategy using historical data to assess its effectiveness before applying it in real-time trading.

- Stay Informed: Keep up-to-date with market news and trends that could impact currency prices.

The Importance of Risk Management

Risk management is a critical aspect of Forex trading that can help protect your trading capital. Some effective risk management techniques include:

- Setting Stop-Loss Orders: Using stop-loss orders can prevent excessive losses by automatically closing positions at a predetermined price.

- Diversifying Your Portfolio: Avoid putting all your funds into a single currency pair to reduce risk exposure.

- Only Risk a Small Percentage: Many professional traders advise risking no more than 1-2% of your trading account on any single trade.

Staying Disciplined

Discipline is a vital trait that successful traders share. Sticking to your trading plan, avoiding emotional decision-making, and learning from mistakes are essential for long-term success in Forex trading. Consider maintaining a trading journal to record your trades, strategies, and emotions, which can help you refine your skills over time.

Conclusion

Forex currency trading online presents both opportunities and challenges for investors seeking to profit from the global foreign exchange market. By understanding the basic concepts, employing effective strategies, choosing the right tools, and practicing diligent risk management, you can enhance your trading experience. As you continue to gain knowledge and experience, you will develop a deeper understanding of the Forex market, opening the door to sustained success.